26.10.2023

The Unicorn and FX Trading - Inaugural Lecture by Hon. Prof. Andreas Schrimpf

Hon. Prof. Dr. Andreas Schrimpf introduced himself to the faculty on October 25th in his inaugural lecture. In his laudatory speech, Professor Joachim Grammig from the Tübingen Department of Econometrics compared him to a unicorn.

On October 25th, Hon. Prof. Dr. Andreas Schrimpf introduced himself to the faculty in his inaugural lecture. However, at the beginning of the event, Professor Joachim Grammig, an econometrics professor at Tübingen, acknowledged the extensive accomplishments and merits of the new colleague and former student of the department. After successfully completing his studies in Tübingen, Andreas Schrimpf did not immediately pursue a career in academia. To describe this path, Professor Grammig highlighted the two typical, usually mutually exclusive career paths of "Financial Economists." On one hand, they can aspire to a career as a professor. This path to the university, however, involves research and, especially, high-profile publications. Alternatively, they can enter the realm of policy advising and central banks, where they provide guidance to decision-makers on significant and exciting financial market and regulation topics. But, as Grammig's unequivocal verdict stated, one must choose. Or, you can be Andreas Schrimpf, who does both, and thus, according to Grammig, Andreas Schrimpf is, in the realm of Financial Economists, a unicorn - a rare species that shouldn't theoretically exist, with outstanding publications in leading journals and a prominent position in an important institution outside the university - in this case, the Bank for International Settlements.

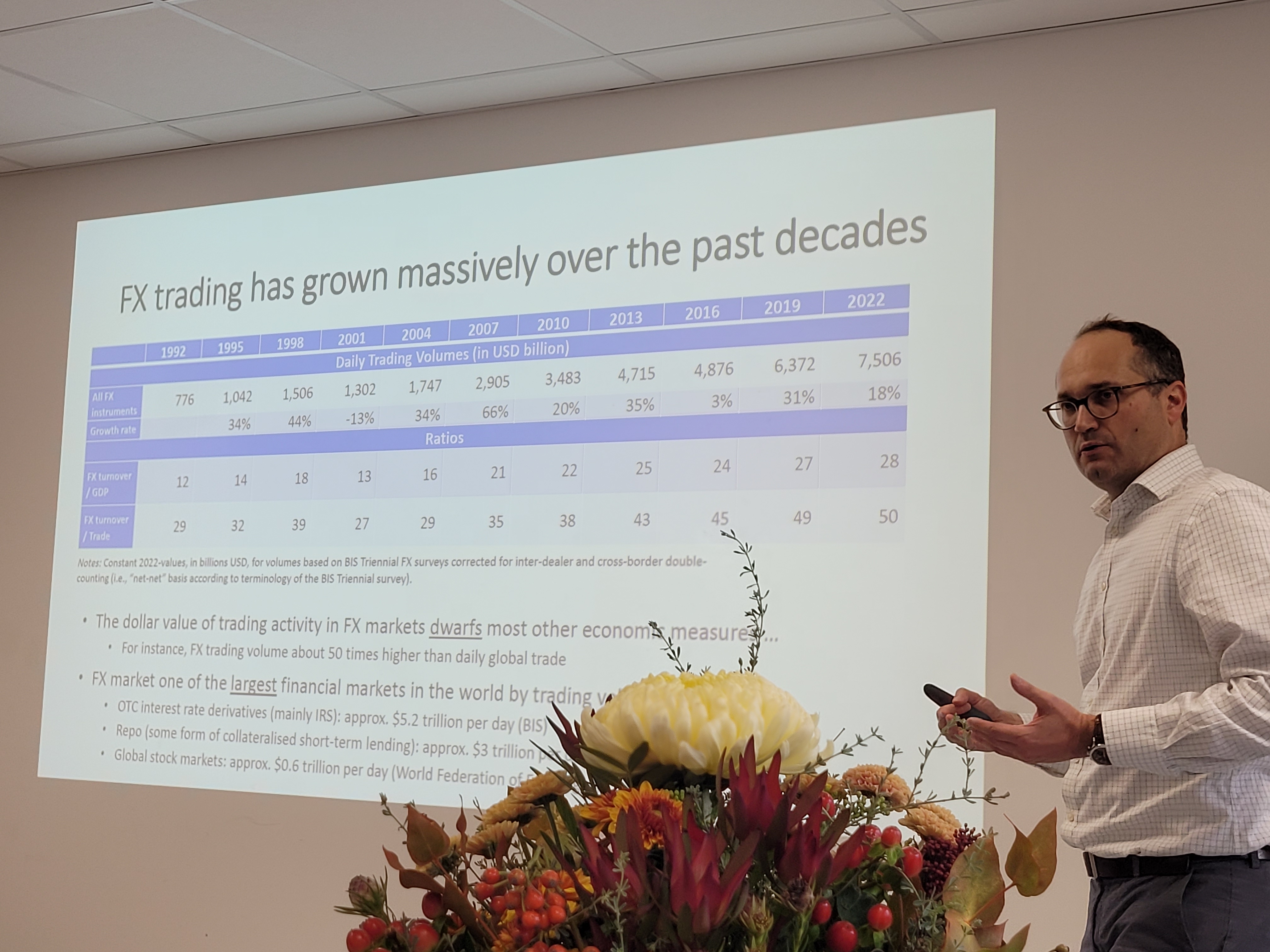

In his inaugural lecture, Hon. Prof. Dr. Andreas Schrimpf drew from a rich reservoir of interesting facts, figures, and statistics from the BIS and immersed the numerous attendees in the world of FX (Foreign Exchange) trading, where currencies are traded on various global markets around the clock. Noteworthy were not only the statistics about trading volume, which is many times greater than international trade in goods and services, but also the various institutional structures that have found their way into the present, partly due to historical path dependencies. For instance, trading is still conducted through traders, sometimes even over the phone. The ensuing discussion during and after the lecture revealed that the topic struck a chord with the audience.

The department welcomes Hon. Prof. Dr. Andreas Schrimpf and looks forward to exciting new insights for research and teaching at the intersection of academia and practical experience in Financial Economics!